As we quickly approach the holiday season, you may already be in the process of finding the perfect gifts for your loved ones. However, if you are a travel rewards enthusiast, there is an important decision you need to make regarding these purchases. You must determine whether it’s best to pay for gifts directly or with your points and miles, thus keeping money in your pocket. Both approaches have advantages and disadvantages, along with potential pitfalls to avoid.

Everyone has their own strategy for maximizing the value of credit cards, points, and miles. Some individuals would never consider redeeming them for gifts, as they prefer to save their rewards for flights or high-end hotel stays. Others view these rewards as a form of currency and primarily use them to reduce everyday expenses. Ultimately, if you spend responsibly this holiday season, there is no wrong way to approach your shopping.

Now, let’s delve into how to make the most of your holiday purchases so you can save money.

Choose the right credit card(s)

During the holiday season, you’ll want to ensure you use the right credit card(s) for your purchases. However, it’s important to note that there isn’t a universal “perfect” credit card for everyone. The ideal choice will vary based on your lifestyle and priorities.

If you have recently acquired a new credit card with a welcome bonus, it should be your primary option for holiday shopping. Following that, consider cards that offer bonus rewards for the specific places where you plan to shop this year.

Earn a bonus on a new card

If you have a considerable amount to spend on holiday shopping, now might be an opportune moment to consider applying for one of the top travel rewards cards.

Most cards require a specific amount of spending within the initial few months to unlock the welcome bonus, and some cards even waive the annual fee for the first year.

If you’ve been reluctant to apply for a card due to concerns about meeting the spending requirement, the holiday season — with its accompanying expenses — presents a perfect opportunity to open a new card. If you’re in search of a new addition to your wallet, here are three cards that currently offer appealing welcome offers:

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Related: Got a new credit card? Tips to help you earn your welcome bonus

Use a card with bonus rewards on holiday spending

Another approach is to use a credit card that offers bonus rewards with popular merchants for holiday shopping. Here are some of the top cards to consider for your holiday purchases:

- Chase Freedom Flex®: This card with rotating categories provides 5% cash back on up to $1,500 spent in the fourth quarter of 2024 at PayPal (among other categories), as long as you activate by Dec. 14, 2024. Since many online merchants offer PayPal as a payment processing method, you can use this card to get bonus cash back on a wide variety of holiday purchases. Although this is categorized as a cash-back card, you can combine your earnings with points from your Chase Sapphire Preferred® Card, Chase Sapphire Reserve® or Ink Business Preferred Credit Card to obtain fully transferable Ultimate Rewards points.

- Discover it® Cash Back: By activating this card’s current bonus categories between now and Dec. 31, you can earn 5% cash back on up to $1,500 spent in the fourth quarter of 2024 at Amazon and Target (then 1% cash back).

The information for the Discover it Cash Back has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Things to consider for your holiday shopping credit card strategy

Add an authorized user

Adding an authorized user to a credit card account offers numerous advantages. Firstly, it aids the primary cardholder in meeting the welcome bonus spending requirements and accelerates the accumulation of rewards. Additionally, authorized users can leverage the primary cardholder’s credit score and credit history, which often leads to improved credit scores.

Moreover, some credit cards provide additional benefits to authorized users, including access to airport lounges and statement credits for Global Entry or TSA PreCheck applications.

Related: Credit cards with the greatest value for authorized users

Why you should avoid store cards

While the strategies above can help you maximize your rewards on holiday purchases, there is one tactic you should avoid: applying for store credit cards. As you shop online or in-store this holiday season, you may receive offers from retailers to open a new store card account. These offers can be tempting, especially when they promise an instant discount of 10% or 20%, along with ongoing rewards.

However, it is generally not worth getting a store credit card. Applying for one usually results in a hard inquiry on your credit report, which can negatively impact your credit score. It will also probably be considered a new account by most card issuers, which can have consequences in the future. Moreover, the discount you receive from a store credit card is unlikely to match the value of a welcome bonus offered by a new travel rewards card.

For instance, if a store card gives you a 20% discount on a $1,000 purchase, you would save $200. While this may seem significant, the best rewards credit cards can provide you with more than $1,000 in value from the welcome bonus alone. Store cards also tend to offer subpar rewards for your spending in the long run.

However, it may be worth enrolling in store-specific loyalty programs (which are usually free), especially if you plan to continue shopping at those retailers. Although these programs may provide better rewards to holders of their respective store credit cards, joining them can still be a relatively effortless way to boost your rewards.

Related: Why you shouldn’t open a store credit card during the holiday season

Use online shopping portals

You’ll probably be doing a lot of your holiday shopping online. Fortunately, there are many ways to make the most of online purchases.

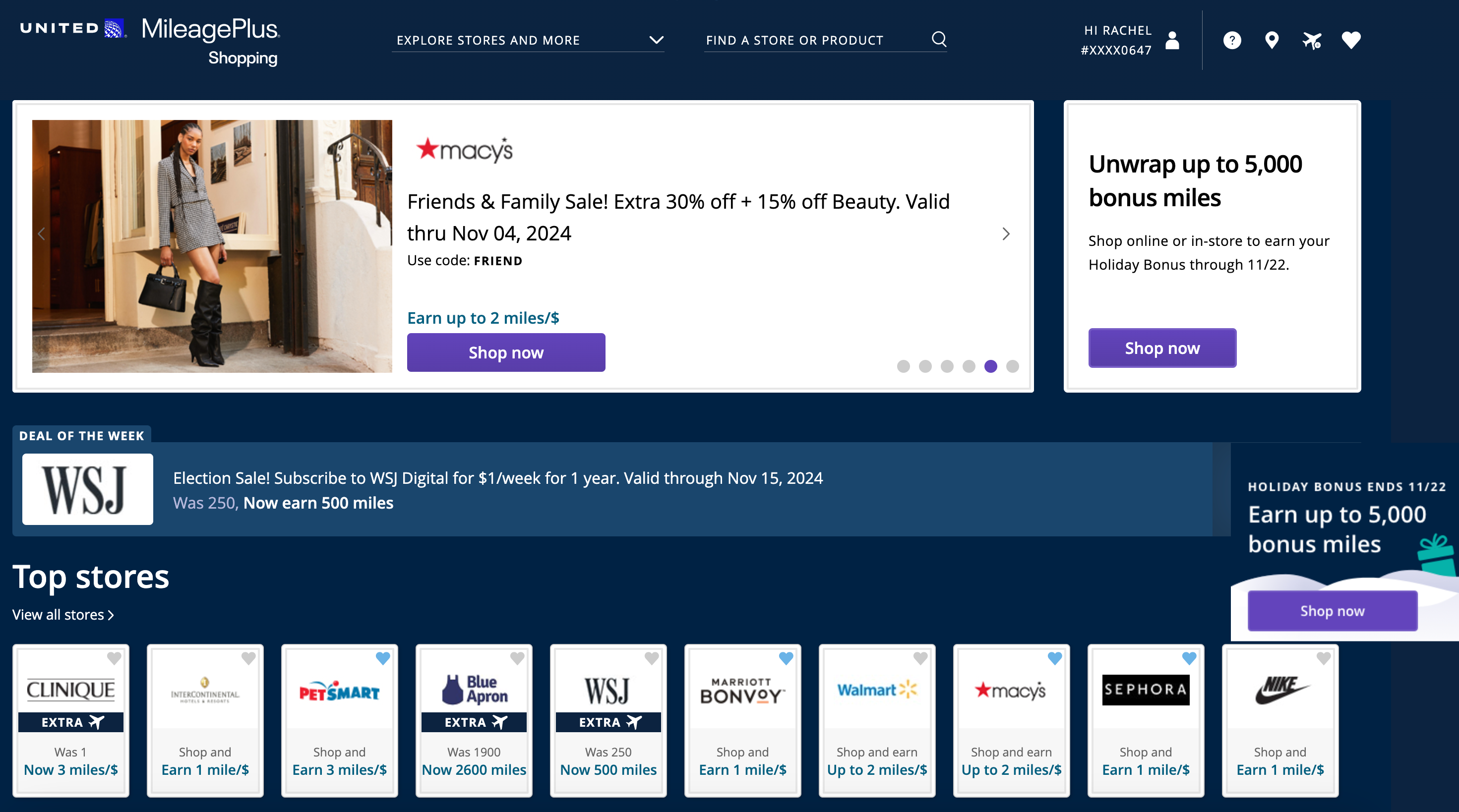

One of our favorite strategies allows you to earn bonus points, miles or cash back on various online transactions, on top of the rewards you’d earn with the credit card you use to pay. We’re talking about shopping portals, and most airline and credit card reward programs have one.

All you need to do is start at the portal instead of going directly to the seller’s site. Sometimes, you can even install a shopping portal extension for your browser. Many popular online retailers, including Target, Home Depot and Macy’s, participate in these portals. It’s a quick and nearly pain-free way to boost your earnings this holiday season.

Popular online shopping portals include:

When choosing which shopping portal to use, consider which rewards are most valuable. Also, keep in mind that although many of these portals are run by the same company (and thus look the same), the payouts can differ. Fortunately, there’s an effortless way to quickly compare earning rates: Use a shopping portal aggregator like Evreward or Cashback Monitor. These sites show a side-by-side comparison of the bonuses you’ll earn across these portals, so you don’t need to fire up each one individually every time you make an online purchase.

Many portals run seasonal bonuses around the holidays to make the rewards you can earn on your holiday shopping spree even sweeter. These typically provide a set number of points when you meet a total spending requirement across all merchants. For instance, the United shopping portal is currently offering 500 bonus miles when you spend $150, 2,000 miles when you spend $600 or 5,000 miles when you spend $1,200. Keep an eye out for these deals as we head into the holiday season. (Note that this offer ends on Nov. 22.)

Related: The beginners guide to airline shopping portals

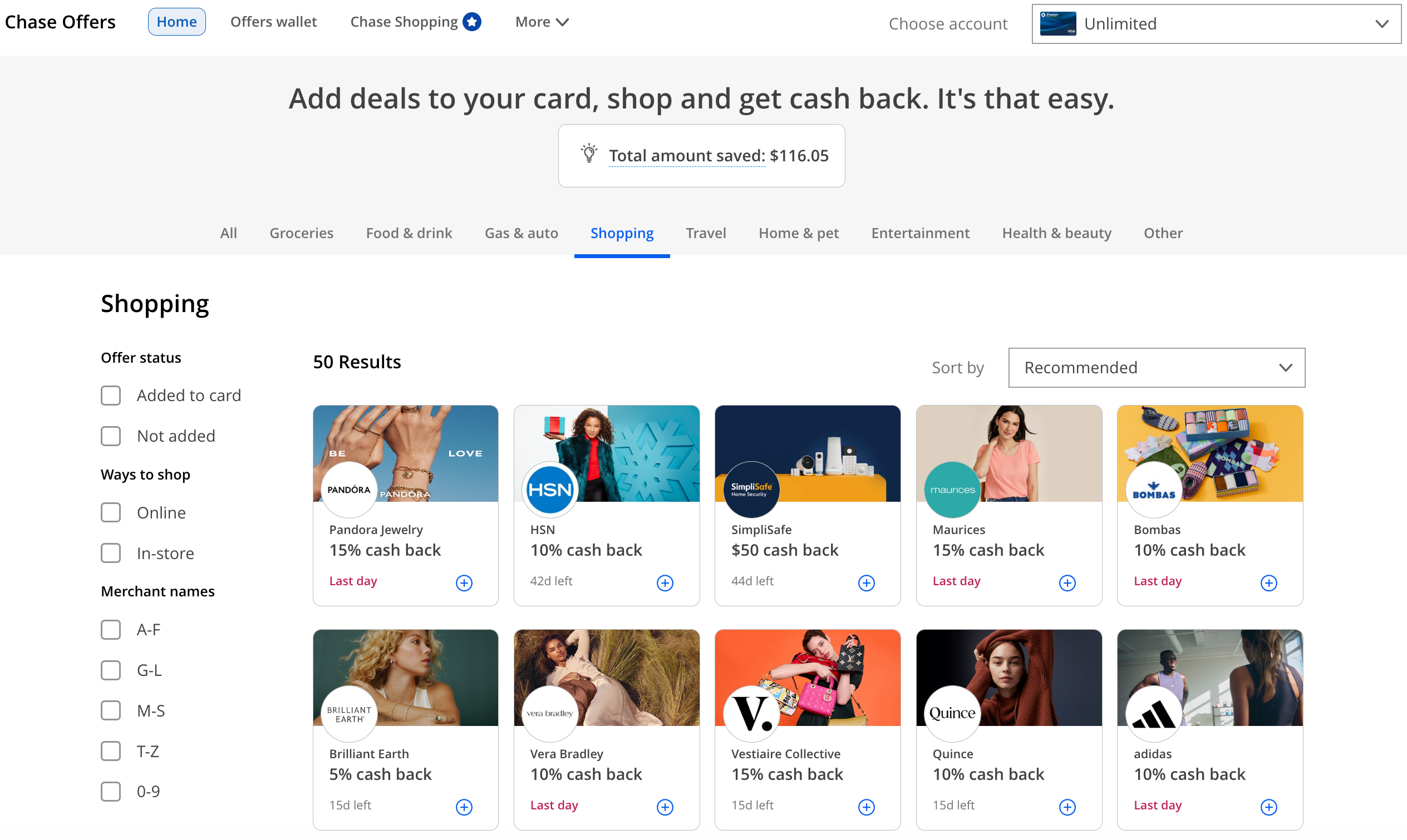

Use credit card perks and offers

Some premium cards offer statement credits that can save you money at select merchants. For instance, for Amex Platinum cardholders, you receive up to $100 in Saks Fifth Avenue statement credits every calendar year — up to a $50 credit is awarded from January to June, and another up to $50 credit is given from July to December. (Enrollment is required.)

Some card issuers, like Amex and Chase, run targeted offers to give you cash back on various purchases. These vary widely from one customer and card to another. It’s always worth seeing what offers are available to you during the holiday season. By combining credit card offers with earnings from online shopping portals, you can receive some impressive discounts on your holiday shopping.

Just remember that these offers typically require activation. You must activate the offer on your card, then use the same card to make the purchase within the time frame specified to earn the cash back.

Related: Your guide to the Amex Platinum Saks Fifth Avenue credit

Get the best purchase protection

Are you purchasing a high-priced gift like an iPhone 16 this holiday season? If so, using the right credit card to buy your big-ticket item can save you money down the road. That’s because some cards cover you with purchase protection.

Purchase protection can save you from the costs of repairing or replacing damaged, stolen or lost items. However, not all credit cards offer this benefit, and the coverage can vary by your state of residence. Just remember to check the specific terms, such as the time period covered and the claim process, as well as the maximum coverage amount provided by your credit card.

Here are a few popular cards with this benefit:

* Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Related: How an often-overlooked credit card benefit put $1,400 back in my wallet

Use points and miles for holiday purchases

Rather than paying for gifts this year, you may be looking to redeem your points or miles for those purchases. This can make sense when you want to minimize out-of-pocket expenses or have many reward points and miles saved up — especially if you aren’t traveling this holiday season.

Even though you’ll generally get more value from travel redemptions, most loyalty programs offer numerous ways to redeem your rewards for merchandise and gift cards. Here’s a rundown of the major programs.

American Express Membership Rewards points

American Express Membership Rewards points are worth 2 cents each based on TPG’s November 2024 valuations. However, in most cases, you’ll be lucky to receive even half that value when you redeem your points for gift cards or merchandise. You’ll only receive 0.5 cents per point when choosing American Express gift cards, and redeeming for other gift cards will often result in values between 0.7 cents to 1 cent per point.

You can also use your Membership Rewards points to pay with points at checkout when shopping with select online retailers. One of these retailers is Amazon, where your points are worth 0.7 cents. That said, there are often promotions where you can save using Amex points.

Related: How to redeem points and miles for Amazon purchases

Chase Ultimate Rewards points

Chase Ultimate Rewards points are worth 2.05 cents each, according to TPG’s November 2024 valuations. You’ll typically get about half that when you redeem for gift cards, merchandise and other nontravel options. Most retail gift card awards have a value of 1 cent per point, but Chase sometimes runs sales on certain retailers, offering you a discount of 10% and raising the value slightly to 1.1 cents per point.

You can also use your Ultimate Rewards points to shop directly with Amazon and PayPal, but you’ll only receive 0.8 cents per point. Not only is redeeming Chase points through Amazon a poor value proposition, but a compromised account could wipe out your Chase balance.

Finally, Chase Pay Yourself Back is a worthy option to redeem points for a statement credit. This feature is available on all Ultimate Rewards-earning cards and allows you to redeem points to offset purchases you’ve already made. You’ll get a value of 1 cent each on most purchases, but promotional categories and merchants can offer you a better value of up to 1.5 cents apiece.

Related: From international business class to domestic hops: 6 of the best Chase Ultimate Rewards sweet spots

Citi ThankYou Rewards points

Citi ThankYou Rewards points are worth 1 cent each when redeeming toward gift cards and 0.8 cents each toward Shop with Points at Amazon. Alternatively, you can get up to 1 cent per point when redeeming toward cash back, depending on your card. This isn’t an ideal redemption, considering Citi ThankYou points are worth 1.8 cents each, according to TPG’s November 2024 valuations.

Citi Strata Premier℠ Card (see rates and fees) cardholders would likely be better off transferring points to one of Citi’s transfer partners. If you transfer your points to an airline or hotel partner, you can get a lot of value when you redeem for last-minute awards or premium experiences. You can also transfer your ThankYou points to any other ThankYou Rewards member for free, which could make a great gift.

Related: How to redeem Citi ThankYou Points for maximum value

Capital One miles

Capital One miles can be used to cover previous travel purchases at a rate of 1 cent each, but you can’t use them to cover nontravel purchases this way. You can redeem them directly through Amazon or PayPal or for a variety of gift cards, but they’ll only be worth 0.8 cents per mile. Compare this to TPG’s November 2024 valuations, which peg Capital One miles at 1.85 cents each.

So you’ll generally be much better off transferring your Capital One miles to hotel or airline partners. You can also share your Capital One miles with anyone as long as they have a miles-earning account, such as one of the Capital One Venture cards or Spark cards.

Bilt Rewards Points

If you hold the Bilt Mastercard® (see rates and fees), your Bilt Points can be used to cover Amazon purchases. While you can use your Bilt Points to cover all or part of your Amazon purchases, you’ll only receive a redemption value of 0.7 cents per point. This is well below TPG’s November 2024 valuation, which values Bilt points at 2.05 cents per point.

Wells Fargo Rewards points

Wells Fargo Rewards points can be redeemed for 1 cent per point for travel purchases. If you want to purchase gift cards with your reward points, you can do so at a value of 1 cent per point for most merchants. Plus, Wells Fargo Rewards is also offering additional promotions, such as 10% off when redeeming points for gift card purchases with select merchants, including Apple, Home Depot, Ulta and more. This gives you a value of 1.11 cents per point.

Though you can get a redemption value of 1.11 cents per point for select gift cards, TPG values Wells Fargo Rewards points at 1.6 cents per point (per our November 2024 valuations). Therefore, to maximize your reward points, leveraging Wells Fargo’s travel transfer partners would help you get the most value.

Related: 7 reasons to get the Capital One Venture Rewards Credit Card

Airline and hotel programs

Many airline and hotel loyalty programs offer the ability to redeem rewards for merchandise and gift cards, but you’ll almost always receive inferior value compared to travel rewards.

Related: Maximizing points and miles to beat inflation and save money

Should you do it?

When you have the option of transferring credit card rewards to airline miles or hotel points, as you do with American Express Membership Rewards, Capital One miles, Chase Ultimate Rewards and Citi ThankYou Rewards, you can come out far ahead of any merchandise or gift card options in terms of redemption value. However, when transfer options don’t exist, you may be able to get the same value when redeeming your rewards for gift cards or merchandise. Alternatively, gifting points may also be a good option.

It’s up to you how you want to redeem your points. For many people, it’s more lucrative to save points for award travel and pay for gifts out of pocket. However, if your rewards balances are overflowing or you value the cash savings of redeeming for merchandise or gift cards, feel free. As the saying goes, value is in the eye of the beholder.

Related: Why transferable points and miles are worth more than other rewards

Consider giving the gift of travel

Remember that most (but not all) loyalty programs let you book travel for others, too. Spending your hard-earned miles to send a friend or family member on a trip might be the ultimate gift you could give this holiday season.

While you could gift points and miles to a loved one, you can also book a trip for them on points. This will give you more value from your points and save your loved one the effort of planning their itinerary.

So, if you’re flush with points and miles, consider booking your college-aged cousin on their next round-trip ticket home from school or treating your parents to their first international business-class ticket. Whatever it may be, you’re giving the gift of travel to those who may not have the resources to do it independently.

To buy a ticket for someone else, book an award trip as normal and simply add the gift recipient’s name and information on the checkout screen. They can then check in for their flight and take off — even if you’re not accompanying them.

Related: How to give the gift of travel

Bottom line

There are many ways to make the most of your holiday purchases this year. Most programs provide straightforward ways to redeem points and miles on gifts for your loved ones, but you’ll generally get more value from transferring points to partner programs or redeeming them directly for travel purchases. If you decide to pay cash and earn rewards on your holiday shopping, be sure to use the tips outlined above to maximize your return.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

See Bilt Mastercard rates and fees here.

See Bilt Mastercard rewards and benefits here.