The global chip shortage was sparked in early 2020 due to the COVID-19 pandemic. Supply issues continued for over three years, impacting industries such as consumer electronics and artificial intelligence.

Nearly every digital electronic device today is powered by semiconductors, which contain silicon and are critical for creating integrated circuits, also referred to as microchips. And anything that needs to compute or process information, such as smartphones, computers, and even everyday appliances, contains a chip.

Unfortunately, chips aren’t that easy to make — some experts estimate that chips take as long as six months to produce. As a result, chip makers said ending the shortage was difficult “because it takes years to get new factories up and running,” according to the WSJ.

By July 2023, manufacturers had ramped up production and their customers had adjusted to more predictable chip supply. Improvements in production capacity and demand for consumer electronics cooling off have allowed industries like automotive to adapt and recover.

However, export restrictions on key semiconductor materials from China, such as gallium and germanium, have fueled fears that a second chip shortage is on the horizon.

What caused the global chip shortage?

Like many things, the chip shortage was the result of greater demand for integrated circuits.

Even prior to the pandemic, the semiconductor supply chain was on shaky ground due to a series of events, including trade wars between the U.S. and China and Japan and Korea, which impacted commodity pricing and distribution. In addition, natural disasters, such as a drought in Taiwan and three plant fires in Japan between 2019 and 2021, contributed to raw material shortages, according to Electronic Products & Technology.

Once the automotive industry, a major buyer of semiconductors, began cutting chip orders in 2020, the semiconductor industry began shifting production to meet demand for other consumer applications. However, demand for cars picked up again in the second half of 2020 as people began avoiding public transportation. This exacerbated the supply and demand challenges further.

SEE: Calculate your computer hardware’s depreciation with this guide from TechRepublic Premium.

The rapid acceleration of the Internet of Things was another factor, and all of these combined variables ” … forever moves semiconductors ahead of oil as the world’s key commodity input for growth,” according to economic investment firm TS Lombard.

Some customers hoarded supplies and bought more components than they needed in case supply dried up. For example, companies such as Huawei stockpiled supplies in advance of U.S. tech bans on China in 2023. These actions further exacerbated supply challenges with semiconductors.

The semiconductor market size

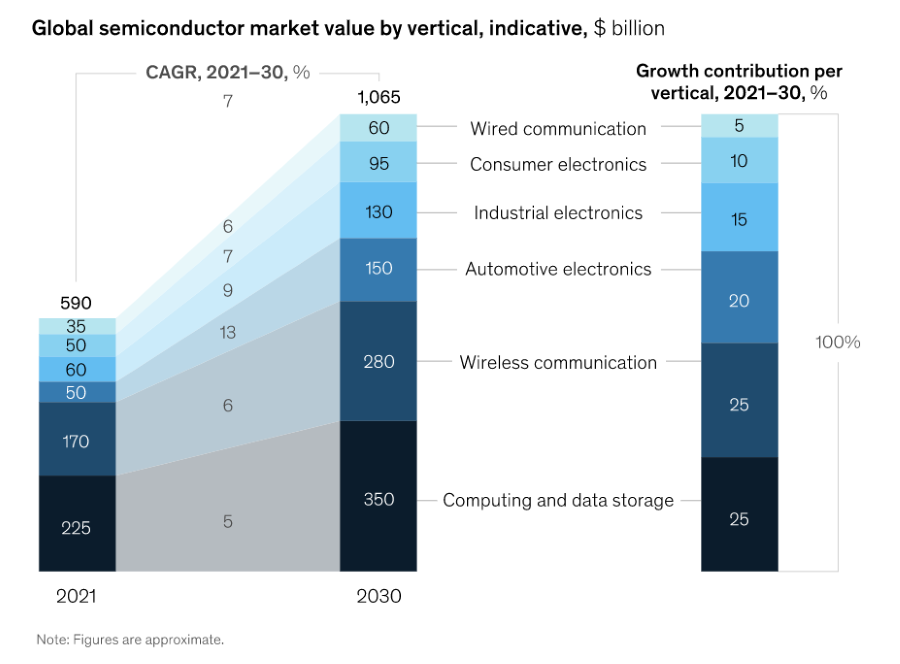

The semiconductor industry grows steadily and remains lucrative. In 2021, McKinsey estimated sales to grow by more than 20% to about $600 billion, with automotive, data storage, and wireless industries leading the market (Figure A). The firm also predicts aggregate annual growth may average between 6% and 8% a year through 2030.

Figure A

This would result in “a $1 trillion industry by the end of the decade, assuming average price increases of about 2 percent a year and a return to balanced supply and demand after the current volatility,” McKinsey said.

The global semiconductor market rose 6.8% in 2020 compared to 2019. It was projected to grow from $573.44 billion in 2022 to $1,380.79 billion by 2029, at a compound annual growth rate of 12.2% in the forecast period, 2022-2029, according to Fortune Business Insights.

How industries were impacted by the global chip shortage

Besides the hard-hit automotive industry, the consumer electronics, industrial, smartphone, wired communications, and server and PC sectors were impacted by the shortage of chips.

Consumer electronics

Consumer electronics benefitted when the automotive industry began slashing vehicle production early in the pandemic. Makers of laptops, TVs, smartphones, cameras, and gaming consoles ordered more chips because their products heavily depend on simple semiconductors:

- Appliances such as refrigerators, dishwashers, washing machines, and microwaves need semiconductors to control and regulate the flow of electricity and make appliances run more efficiently.

- Personal computers have CPUs that act as their brain by executing instructions and calculations.

- Mobile devices and smartphones use chips for communication, processing, memory, and display — for example, smartphones have a chip to connect to a cellular network, a chip to enable touchscreen input and a chip that stores a user’s data.

The consumer electronics industry had to raise prices in the face of shortages as demand exceeded supply and more people began working and going to school remotely, requiring more laptops, desktops, and other systems. However, because demand tends to be cyclical, the high demand for consumer electronics has tapered off.

Artificial intelligence

AI and GPUs require a special type of chip to train and deploy AI models as demand for AI computing power grows, Chris Miller, a professor of history at Tufts University and author of “Chip War: The Fight for the World’s Most Critical Technology,” told Marketplace. These specialized and costly GPUs are primarily made by NVIDIA at a manufacturing plant in Taiwan, according to Miller.

NVIDIA and other GPU suppliers struggled to meet the skyrocketing demand for chips used in AI applications, cloud computing, and machine learning due to supply chain disruptions during the global chip shortage. This bottleneck delayed the development and deployment of AI technologies.

“As the economy slows, people are buying fewer smartphones, companies are spending less money updating their data centers,” Miller explained in the Marketplace article. “But for the specific types of chips that are used for AI, there’s actually a boom and some shortages that are already becoming visible. And it seems like the demand for these types of chips is only set to grow.”

Why did recovery from the chip shortage take so long?

Supplies of chips began to improve in 2022, due in part to additional capacity with the slowdown in sales of PCs, smartphones, and consumer electronics. Foundries in Taiwan reallocated some of this capacity to the automobile and industrial end markets, according to JP Morgan.

However, automakers increasingly require chips with higher computing power — especially as the industry transitions to electric and autonomous vehicles, which are significantly different from the ones used in PCs and smartphones.

Other roadblocks included tensions between the U.S. and China, which continue to impact the global supply chain. This is ” … spurring new government controls on sales of chips to China,” the world’s largest semiconductor market, the Semiconductor Industry Association, noted in its State of the U.S. Semiconductor Industry report.

There were other significant policy challenges as well, such as the need to strengthen the U.S. semiconductor workforce by reforming the country’s highly skilled immigration and STEM education systems. This would have increased the number of workers and helped contain the talent shortage, according to the SIA.

The SIA added that macroeconomic headwinds and market cyclicality “caused a short-term downturn in sales.”

Demand remains unpredictable

There are some predictions that we will see another chip shortage due to a ” … mismatch between supply and demand that cannot be addressed quickly either by chip manufacturers … scaling up production or by markets by adapting to the chip production profile,” Rakesh Kumar wrote in Fortune. “The challenge of resolving the two isn’t going away — and may even grow in size.”

Semiconductor demand is unpredictable, Kumar explained. AI, electric and autonomous vehicles, the Internet of Things, and 5G and 6G will drive future chip demand.

“Yet the exact nature, speed and magnitude of that increase in demand is still unknown,” Kumar wrote.

Semiconductor industry faces a lack of skilled engineers

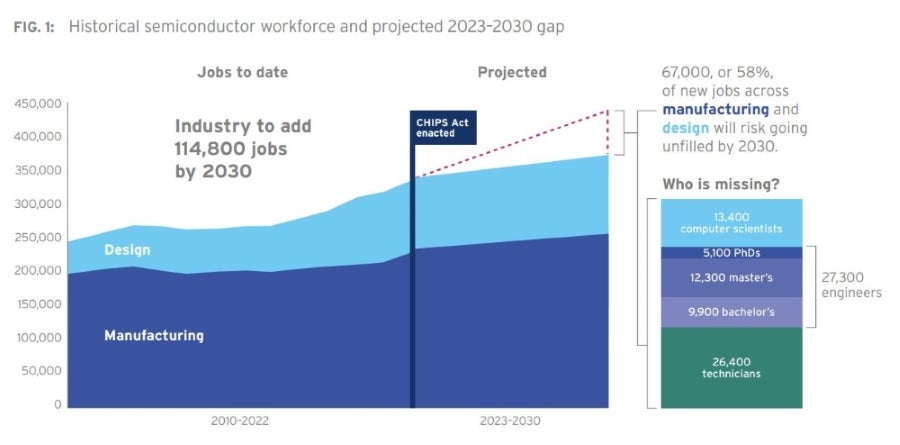

There’s another issue: Even as efforts are made to open up new semiconductor fabs, a lack of skilled engineers may mean that many of the jobs created won’t be filled. According to new data from the SIA, the industry is projected to grow by more than 115,000 jobs by 2030, with 67,000 jobs at risk of being unfilled (Figure B).

Figure B

Expanding the supply of skilled designers and other semiconductor professionals will require a sustained effort for many years or even decades, said Tony Chan Carusone, CTO of Alphawave Semi and professor of electrical engineering at the University of Toronto.

“This talent squeeze is not unique to the semiconductor industry but rather is going to affect the entire technology ecosystem,” Chan Carusone told TechRepublic. “For companies who are filling semiconductor roles, creating a more robust talent pipeline should be a top priority.”

The industry is ” … faced with a challenging obstacle due to the fact that chip technology is not easily visible or tinkered with, unlike software,” Chan Carusone added. “This creates difficulty in attracting young tech professionals to pursue careers in hardware and semiconductors.”

Chan Carusone expressed hope that as one of the most important subindustries within tech, people will consider a career in semiconductors, which ” … is fast-paced, constantly evolving and can be much less volatile than a career in software.”

What efforts are being made to end the chip shortage?

Despite the challenges, the SIA says the long-term outlook for the semiconductor industry remains strong, with initiatives and policies being made to increase semiconductor research and production globally.

Global policies push for semiconductor research and development

In 2022, the U.S. passed the CHIPS Act, which ” … has begun in earnest in 2023,” according to the SIA’s report. The CHIPS Act was enacted by the U.S. government to provide needed semiconductor research investments and manufacturing incentives and to reinforce America’s economy, national security, and supply chains.

The goal of the $280 billion expenditure is to prevent U.S. industries from falling prey to similar semiconductor supply chain chaos in the future.

Since 2022, ” … companies from around the world have responded enthusiastically, announcing dozens of new semiconductor ecosystem projects in the U.S. totaling well over $200 billion in private investments,” the SIA said. “These projects will create tens of thousands of direct jobs in the semiconductor ecosystem and will support hundreds of thousands of additional jobs throughout the U.S. economy.”

In a push to bolster domestic semiconductor production overseas, the European Union has approved the EU’s Chips Act, with the goal of producing 20% of the world’s semiconductors by 2030, Bloomberg reported. However, in September 2024, the European Semiconductor Industry Association called for a “Chips Act 2.0,” which includes fewer export restrictions and would accelerate the distribution of aid to help the bloc achieve its goal.

Semiconductor industry makes an effort to build new plants

New plants at sites in Europe have already been announced by chip makers, including Intel and STMicroelectronics. Intel revealed it will make its chip manufacturing and foundry unit a stand-alone business but remain under its corporate umbrella.

As of the start of 2024, IBM’s Altera will compete for business like other external suppliers.

“It’s expected that this change will save as much as $3B this year and continue to generate savings to Intel’s bottom line going forward,” wrote industry analyst Jack Gold in a LinkedIn post. “This is a major change to how Intel builds chips and we think it’s an important move that’s overdue.”

Intel said the move will help it achieve its stated cost savings goal of more than $8 billion to $10 billion by the end of 2025.

Semiconductor marketplace launches to alleviate chip supply pain points

In late September 2023, the Partstack Marketplace launched as a semiconductor chip search platform for engineers, designers, and equipment manufacturers. Partstack aims to bring global semiconductor buyers and sellers together to quickly locate, buy, or sell millions of hard-to-find semiconductor parts from over 2,500 unique manufacturers, according to its maker, semiconductor and electronics solutions provider Partstack Corporation.

Partstack offers datasheets, guides for chip testing best practices, and counterfeit component reporting features. It provides a catalog of component pricing and availability data from global suppliers, the company said.

Will there be another global chip shortage?

The initial outlook after the chip shortage eased was positive. IEEE predicted the supply to grow ” … from older chip fabs and foundries running processes far from the cutting edge and on comparatively small silicon wafers.”

In addition, IEEE estimated that more than 40 companies would increase capacity by more than 750,000 wafers per month by the end of 2022. Intel, TSMC, Texas Instruments, and Samsung — the world’s largest memory chipmaker — all announced plans to build fabs in the U.S.

Despite this growth, research from Omdia found that revenue from the semiconductor market declined by 9% in 2023 over the previous year. This was due to the demand for consumer devices softening in a weakened economy, but the chip supply continued to increase.

There are also ” … several wild cards that could cause more disruption, such as the global economy, geopolitical tensions, and the shortage of equipment for manufacturing bleeding-edge chips,” observed management consulting firm Bain & Co.

However, the largest indicator of a future chip shortage is the policy changes in China. In July 2023, the country’s Ministry of Commerce announced it would implement export controls on gallium and germanium-related items “to safeguard national security and interests.” There is speculation that the move came in retaliation to export controls on the sale of semiconductors to China from the U.S. imposed in October 2022.

But the U.S. is not the only country that has cooled off trading with China, as the Netherlands and Japan also jointly agreed to impose export controls on chipmaking kits in January 2023. The U.K. also blocked the majority of license applications for companies seeking to export semiconductor technology to China in 2023.

China’s restrictions were enforced in August 2023, and according to data from the Financial Times, the cost of the minerals has almost doubled in the year since. The country produces 98% of the world’s supply of gallium and 54% of germanium, and the FT found that exports dropped by 12,000 kg and 14,359 kg, respectively, from the first half of 2023 to the second.

“The United States is heavily reliant on imports for both of these critical minerals, especially from China, given its dominant role as a major producer and supplier of both products,” according to the U.S. International Trade Commission.

The long-term outlook is uncertain. Easing off on the West’s restrictions could help prevent a second global chip shortage, but doing so would reinstate concerns about China’s “ability to both purchase and manufacture certain high-end chips used in military application,” cited by the U.S. Department of Commerce.

But seemingly the opposite has occurred, as the U.S. rolled out a series of new chip-related export controls on China in September 2024.

“Assuming the global situation and US-China relationship stays as it is, then I don’t see any motivation for China to relax the export controls,” an employee at a large consumer of semiconductor materials told the FT.

SEE: Check out all of TechRepublic’s cheat sheets and smart person’s guides.